To many readers, taxes may seem a boring subject. However, taxes are a key instrument to combat poverty and inequity. In fact, the main sources for funding transfers, such as food stamps in the U.S., are taxes. In equitable societies, the combination of taxes and transfers, also known as fiscal policy, can increase access to education and healthcare, and can reduce inequality and poverty substantially.

Given its importance, my research in the past decade has concentrated on assessing fiscal policy’s impact on inequality and poverty. As part of this effort, I launched the Commitment to Equity (CEQ) project at the Inter-American Dialogue, a Washington-based think tank, in 2008. When I joined Tulane in 2009, I brought the project with me. With the invaluable input from Tulane’s Center for Inter-American Policy and Research and the Department of Economics; generous support from the Bill & Melinda Gates Foundation (BMFG); and collaboration from our partner organizations, the Center for Global Development and the Dialogue, CEQ’s scope expanded significantly. In 2015, I founded the Commitment to Equity Institute (CEQI). With more than one hundred researchers throughout the world, the CEQI works to reduce inequality and poverty through comprehensive and rigorous fiscal incidence analysis and active engagement with the policy community.

The results indicate that, on average, the poor in Armenia, Ethiopia, Ghana, Guatemala, Nicaragua, Tanzania, and Uganda pay more in taxes than they receive in support.

Rooted in the field of public finance, fiscal incidence analysis is designed to measure who bears the burden of taxes and who receives the benefits of government spending, and in particular, of social spending. The difference in inequality before taxes and transfers and inequality after them indicates the redistributive effort of a particular country. In the U.S., for instance, taxes and transfers decrease inequality by about a quarter, while in Guatemala they only decrease inequality by five percent. To make the fiscal incidence analysis methodology as widely accessible as possible, in 2018 we published the Commitment to Equity Handbook: Estimating the Impact of Fiscal Policy on Inequality and Poverty, a multi-author manual that presents a step-by-step guide to applying fiscal incidence analysis. Thanks to the BMGF Open Access policy, the online version of the handbook is available free of charge.

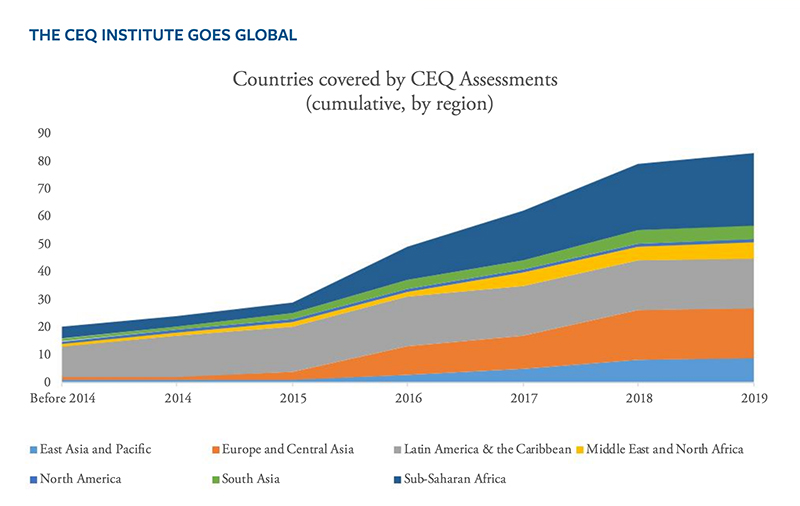

While fiscal incidence exercises are available in practically all developed countries, analysis of the impact of fiscal policy on inequality and poverty in low- and middle-income countries was either not available or dated, which made comparisons across countries or over time extremely difficult. This has fundamentally changed since we launched CEQ. Initially focused on Latin America, the project began with pilot studies in Argentina, Brazil, Peru, and Uruguay. With the generous support of the BMGF, which has awarded CEQ $5.5 million in grants since 2013, and fruitful partnerships, we have been able to study and analyze countries in all regions of the world (see graph below).

Today, the World Bank has mainstreamed our tool and uses it in policy dialogues and lending operations in more than 50 countries. Additionally, the CEQI collaborates with the International Monetary Fund (IMF) to assess the distributive impact of policy alternatives in their programs, especially in Sub-Saharan Africa, and also works with the Inter-American Development Bank, the Organisation for Economic Cooperation and Development (OECD), and the United Nations International Children’s Emergency Fund (UNICEF). In order to reach the public more broadly, the institute has partnered with Oxfam, which uses CEQ results to support their mission to foster a more equitable world. This remarkable expansion in country coverage was often demand-driven. For example, after presenting results for Latin American countries at an event in Washington in 2013, an officer from the Indonesian Ministry of Finance approached the World Bank and requested help to implement such an analysis in his country. This gave rise to joint projects in multiple countries with the World Bank, including, of course, Indonesia.

One of the key findings of our research is that although fiscal systems reduce inequality—albeit little in most developing countries—in many countries, the poor are made poorer by fiscal policy. The results indicate that, on average, the poor in Armenia, Ethiopia, Ghana, Guatemala, Nicaragua, Tanzania, and Uganda pay more in taxes than they receive in support. In Ethiopia, this unpalatable result has led to policy change. In January 2016, the Ethiopian government expanded the coverage of its flagship transfer program to include poor households living in urban areas, and that July, the government raised the threshold of taxable personal income. While these policy changes may not have been enough to completely eliminate the problem, it was an important step in the right direction.

While producing a tool that has been proven very useful for policymakers, CEQ studies have also been published in leading peer-reviewed journals and numerous book chapters. Within the CEQI, Tulane undergraduate and graduate students are able to sharpen their research and teaching skills, expand their professional networks, and travel the world. Our doctoral students have been trainers on the CEQ methodology at the World Bank and other multilateral organizations, participated in prestigious international conferences, and published even before they graduated, giving them an edge in today’s competitive job market.

When the CEQ was launched in 2008, our goal was to produce estimates of fiscal redistribution in Latin America. Ten years later, we have fulfilled that goal and are in the process of completing studies for an additional 50 countries from all regions of the world. The tool is being used by multilateral organizations and governments to assess the implications of tax and subsidy policy reforms. Our work proudly continues to influence the discourse and the policies in a rising number of places around the world.

Nora has increased the visibility of Tulane as a cutting-edge center for the study of inequality and poverty and how these are impacted bound the world. Nora has brought Tulane to high level academic circles with leading scholars on these subjects, including Thomas Piketty, Branco Milanovic, François Bourguignon, and Emmanual Saez, to name just a few. She has also inserted Tulane into the core of the multilateral organizations that most matter for poverty and inequality around the world, like the World Bank, the International Monetary Fund, and the OECD.

– Ludovico Feoli, Executive Director of Tulane’s Center for Inter-American Policy and Research